PM Youth Business & Agriculture Loan Scheme

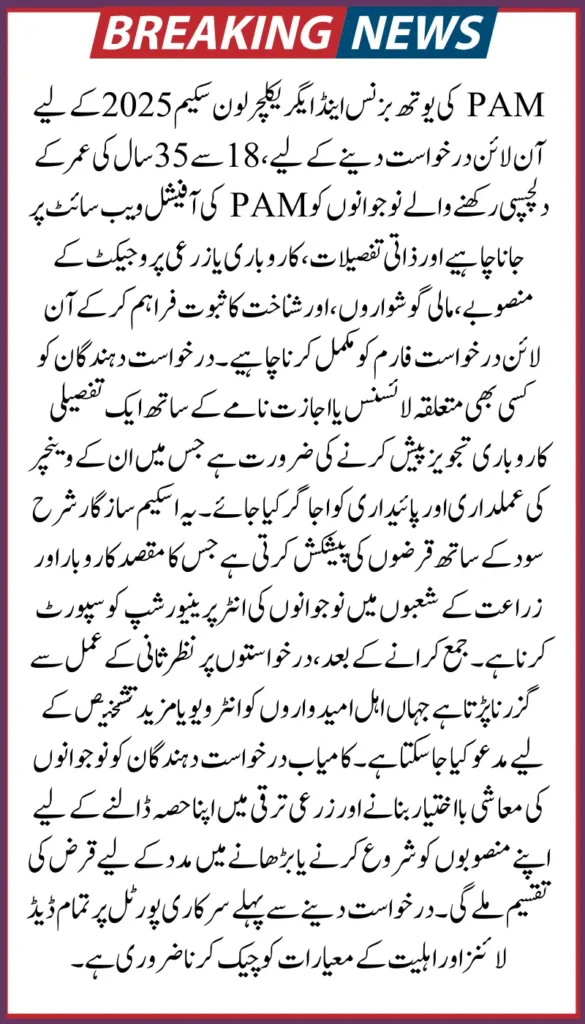

Are you a young entrepreneur in Pakistan with a business idea but no capital to start? The PM Youth Business & Agriculture Loan Scheme 2025 is your chance to turn your idea into a reality. This government-backed loan scheme helps young individuals across Pakistan start or grow their businesses with easy financing and minimal requirements.

In this complete guide, you’ll learn everything you need to know about the scheme, including eligibility, required documents, and step-by-step instructions for applying online in September 2025.

What is the PM Youth Business & Agriculture Loan Scheme 2025?

The PM Youth Business & Agriculture Loan Scheme 2025 is a special initiative by the Government of Pakistan to support young entrepreneurs. It is part of the broader Kamyab Jawan Program, which aims to reduce unemployment and boost economic growth by promoting entrepreneurship.

This scheme provides low-interest and interest-free loans to individuals who want to start a new business or expand an existing one. Whether you are in IT, e-commerce, agriculture, or manufacturing, this scheme can help you get started.

Rs. 200 Prize Bond Draw September 2025 – Complete Winner List Announced Check it Now

Key Features of the PM Loan Scheme 2025

Here are the most important features of the PM Youth Business & Agriculture Loan Scheme 2025:

Tiered Loan Structure

The scheme offers three loan tiers based on the size of the business:

- Tier 1: Loans up to Rs. 500,000 interest-free and no collateral required.

- Tier 2: Loans from Rs. 500,000 to Rs. 1.5 million with a subsidized interest rate.

- Tier 3: Loans from Rs. 1.5 million to Rs. 7.5 million with competitive interest rates.

Flexible Repayment Tenure

You can repay your loan over a period of up to 8 years, including a 1-year grace period (no payments for the first year).

Debt-to-Equity Ratio

- For new businesses, you only need to contribute 10% of the total cost (the loan covers 90%).

- For existing businesses, you don’t need to provide any equity.

Inclusion and Accessibility

- 25% quota for women

- Encouragement for transgender individuals and people with disabilities

- Available across all regions of Pakistan, including Gilgit-Baltistan and AJK

IMF to Evaluate Pakistan’s Fiscal Strategy and Flood Relief Spending in Upcoming Review Mission

Eligibility Criteria (Updated for September 2025)

Before you apply for the PM Youth Business & Agriculture Loan Scheme 2025, make sure you meet the following eligibility criteria:

- Nationality: Must be a Pakistani citizen with a valid CNIC.

- Age: Between 21 and 45 years. (Minimum age is 18 for those in the IT or e-commerce sectors.)

- Business Type: You can apply for a new business or to expand an existing one.

- Education: No formal education required for Tier 1, but relevant experience or qualifications will strengthen your application.

Required Documents for Online Application

Before applying online, prepare scanned copies of the following documents:

You can download ready-made feasibility reports for over 200 business ideas from the PMYP website to help you build your business plan.

Step-by-Step: How to Apply Online for PM Youth Loan 2025

Applying for the loan is easy and fully online. Follow these simple steps:

Step 1: Visit the Official Website

Go to: https://pmyp.gov.pk

Only use the official portal to avoid scams.

Step 2: Click on the Loan Scheme

On the homepage, look for the “Youth Business and Agriculture Loan Scheme” and click it.

Step 3: Start the Application

Click on “Apply for Loan”.

Enter your CNIC, issue date, and mobile number.

You’ll get a verification code (OTP) via SMS.

Step 4: Fill the Application Form

The form includes the following sections:

- Personal Information (Name, CNIC, address, etc.)

- Loan Details (Tier, loan amount, equity)

- Business Information (Sector, business idea, purpose)

- Financial Estimates (Expected income, expenses)

Step 5: Upload Your Documents

Upload clear, scanned copies of all the documents listed earlier.

Step 6: Review and Submit

Carefully review all the details. If everything is correct, accept the terms and conditions and click “Submit”.

What Happens After You Apply?

Once you apply:

- You’ll receive a tracking ID via SMS.

- Your application will go through initial screening.

- It is then forwarded to the bank you selected.

- Verification may include a home or business visit.

- If approved, you’ll sign the agreement and receive the funds in your bank account.

The entire process can take between 30 and 60 days.

Tips for a Successful Application

- Write a strong business plan with clear goals and financial estimates.

- Use realistic numbers when estimating income and expenses.

- Double-check all information before submitting.

- Make sure your contact details are correct, as banks may reach out to you.

Final Thoughts: Build Your Future with PM Youth Loan Scheme 2025

The PM Youth Business & Agriculture Loan Scheme 2025 is more than just financial support — it’s a doorway to independence, growth, and success. Whether you want to start a tech startup, open a small shop, or modernize your farm, this loan can help you take the first step.

By following this guide, preparing the right documents, and applying online through the official PMYP portal, you increase your chances of approval. Don’t miss this opportunity to be your own boss and contribute to Pakistan’s growing economy.

Punjab Green Credit Program Boosts E-Bike Adoption for Eco-Friendly Transport