Roshan Gharana Solar Loan Scheme from Agahe Pakistan

Pakistan stands at the cusp of a significant energy revolution, driven by initiatives like the Roshan Gharana Roshan Pakistan Solar Loan Scheme. This visionary program, gaining immense traction nationwide, particularly in regions like Punjab, aims to empower citizens by making solar energy more accessible and affordable. As the world grapples with climate change and rising energy costs, Pakistan’s commitment to renewable energy through this scheme is not just an environmental imperative but also a strategic move towards energy independence and economic stability. This comprehensive article examines the intricate details, features, benefits, and prospects of this groundbreaking scheme, offering a detailed perspective for individuals, policymakers, and investors.

Roshan Gharana Roshan Pakistan solar loan

The core philosophy of the “Roshan Gharana Roshan Pakistan” scheme is simple yet profound: to bring sustainable and affordable electricity to every household. For decades, Pakistan has faced challenges related to energy shortages, high electricity tariffs, and a heavy reliance on fossil fuels. These issues have not only strained household budgets but also hindered industrial growth and contributed to environmental degradation.

Kalash Marriage Bill: A Historic Step to Protect Indigenous Rights & Cultural Identity in Pakistan

What is the purpose of the solar loan scheme?

The Solar Loan Scheme is a multi-purpose solution and has been launched to reduce electricity consumption. Its objective is as follows:

- Reduce the burden of electricity bills: By allowing households to generate their own electricity, this scheme directly addresses the rising cost of electricity.

- Promote the adoption of renewable energy: The shift away from fossil fuels to solar energy is in line with global efforts to combat climate change and reduce carbon emissions.

- Enhance energy security: Decentralized power generation through solar panels reduces reliance on centralized grids, making communities more resilient to power outages.

- Create economic opportunities: Installing and maintaining solar systems creates jobs and stimulates local economies.

- Improve quality of life: Consistent access to electricity improves quality of life, supports education, and promotes small businesses.

Key Features of Solar Loan Scheme in 2025

By 2025, the Roshan Gharana Roshan Pakistan Solar Loan Scheme will have evolved to offer more attractive and accessible features:

1. Improved Financial Accessibility:

- Concessional Interest Rates: The government continues to offer significant subsidies on interest rates, making solar loans more affordable than conventional loans. This ensures that a wide demographic, including middle-income families, can participate.

- Flexible Repayment Plans: The loan repayment period has been extended with options ranging from 10 to 15 years, allowing for manageable monthly installments as per the borrower’s income. Early repayment options without any penalty are also available, providing flexibility.

- Increased Loan Limit: Recognizing the rising costs of technology and installation, the maximum loan amount has been increased to accommodate a wider range of solar systems, from basic home setups to larger systems capable of meeting high energy needs.

- Minimal Documentation: The application process has been streamlined with bureaucratic hurdles and minimal documentation requirements, ensuring faster processing and approval times, often within 10-15 business days.

BISP & BBSHRRDB Partner for Skill Training of 3,000 Beneficiaries Under Benazir Hunarmand Program

Access Loan Solar Scheme across Pakistan.

The Roshan Pakistan Roshan Ghar scheme has made a significant impact on solar financing, with a number of leading banks and financial institutions across the country actively participating to make clean energy accessible to all citizens. The program is available to a wide range of individuals, including salaried, self-employed, and business persons, with varying eligibility criteria regarding income and employment history. Through this initiative, Pakistanis can access subsidized loans with competitive markup rates and flexible repayment periods, allowing them to install solar systems and take control of their electricity costs, ultimately contributing to a more sustainable and energy-independent nation.

Nationwide Holiday Declared on Sept 6, 2025 for Eid Milad-un-Nabi by Federal Govt

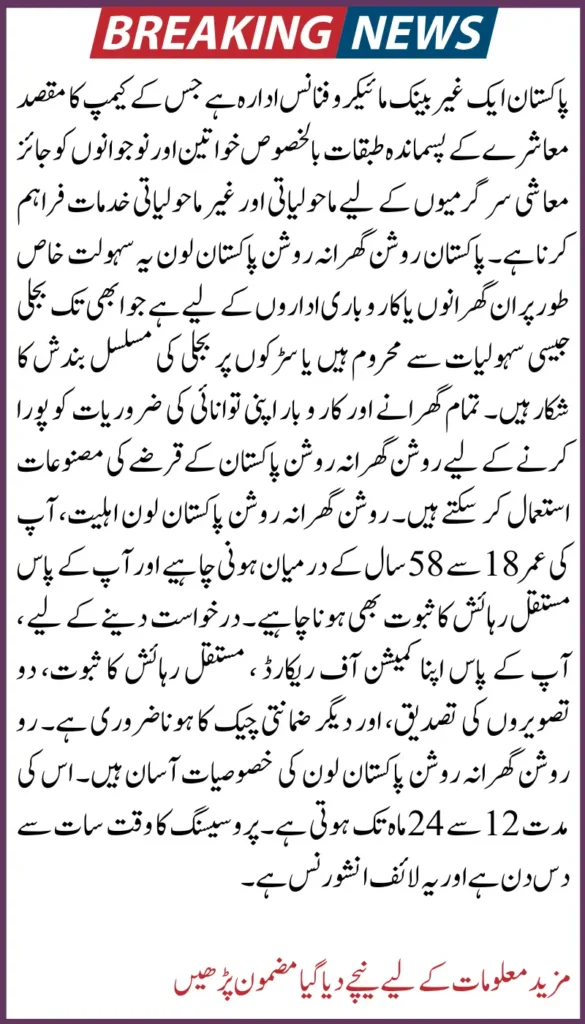

Eligibility for a loan

To be eligible for this scheme, your age, target family size, and desired quota must all be fully verified.

Required documents

- Copy of National Identity Card

- Proof of Permanent Residence

- 2 Passport Size Photos

- Social Security

- Affidavit

- Two Surety Bonds

The loan facility is specifically for households and businesses that are still without electricity or are facing frequent load shedding. Roshan, Aghahi Pakistan’s loan product, can be used by all households and businesses to meet their energy needs. Loan repayments range from Rs. 40,000 to Rs. 500,000.

How to Apply

The application process is typically straightforward and involves a few key steps:

- Obtain a Quotation: Get a detailed quotation for the solar system from an authorized energy partner that is approved by the bank offering the scheme.

- Submit Application: Fill out the application form provided by the bank.

- Gather Required Documents: Prepare and submit the necessary documents. These generally include:

- A copy of your CNIC.

- The signed application form.

- A copy of your latest electricity bill.

- Proof of income (e.g., pay slips, bank statements, employment letters, or audited financials for businesspersons).

- Tax returns.

- Two references.

- Documents related to property ownership.

To start the process, you can visit a local branch of a participating bank, Call their customer service center. Or check their official website for a dedicated solar loan section and a list of authorized energy partners.

PMT Score Check 2025: Official Guide to Verify Eligibility for BISP & Ehsaas Program